1. What is BOP Roshan Digital Account (RDA)?

Roshan Digital Account, an initiative of SBP, is an opportunity for Non-resident Pakistanis to open an account with BOP-Conventional/BOP-Taqwa Islamic Banking (BOP-TIB) comfortably through a completely digital process.

Resident Pakistanis who have duly declared assets held abroad, as per wealth statement declared in latest tax return with the Federal Board of Revenue (FBR) can also open an RDA.

2. What are the types of accounts offered under Roshan Digital Accounts?

Roshan Digital Account (RDA) is available in both Current and Savings Account variants and in Pakistani Rupees (“LCY”) and Foreign Currency (“FCY”).

LCY accounts are:

i. Non-Resident Rupee Value Account (NRVA)-Saving

ii. Non-Resident Rupee Value Account (NRVA)-Current

FCY accounts are:

iii. Foreign Currency Value Account (FCVA)-Saving

iv. Foreign Currency Value Account (FCVA)-Current

3.What is the definition of “Non Resident Person”?

The definition of non-resident has been adopted from the Income Tax Ordinance (Chapter 5, Division II, Section 82), which is as follows:

An individual shall be treated as non-resident for a tax year if the individual —

i. is outside of Pakistan for a period of, or periods amounting in aggregate to, 183 days or more in the tax year (July to June); or.

ii. is outside of Pakistan for a period of, or periods amounting in aggregate to, 120 days or more in the tax year and, in the four years preceding the tax year, has been outside of

Pakistan for a period of, or periods amounting in aggregate to 365 days or more.

4. What investment opportunities are allowed from these accounts?

A. Investments allowed from NRP Rupee Value Account (NRVA):

i. Pakistani-rupee denominated Naya Pakistan Certificate (NPC) / Islamic Naya Pakistan Certificate (INPC)

ii. Pakistani-rupee denominated Fixed/Term Deposit products / Riba Free Certificate of the Bank

B. Investments allowed from Foreign Currency Value Account (FCVA):

i. USD denominated Naya Pakistan Certificate (NPC) / Islamic Naya Pakistan Certificate (INPC)

ii. GBP denominated Naya Pakistan Certificate (NPC) / Islamic Naya Pakistan Certificate (INPC)

iii. EUR denominated Naya Pakistan Certificate (NPC) / Islamic Naya Pakistan Certificate (INPC)

iv. Foreign currency fixed/term deposit products.

5. What are the currencies offered for opening RDAs?

BOP is offering accounts in USD, PKR, GBP, EUR only.

6. Who is eligible to open RDAs?

Following individuals are eligible to open RDA Accounts:

i. A non-resident individual Pakistani.

ii. A non-resident POC holder.

iii. A resident individual Pakistani who has duly declared assets held abroad, as per wealth statement declared in latest tax return with the Federal Board of Revenue (FBR) can open FCVA only.

iv. Employees or officials of the Federal or Provincial Governments posted abroad in the tax year.

7. What are the minimum documents required to open a Roshan Digital Account?

Following Original scanned documents are required to open a Roshan Digital Account:

i. Original scanned CNIC/ NICOP/ POC

ii. Original scanned Passport (first 2 pages) (Pakistani and/or foreign/ other country)

iii. Proof of NRP status (e.g. scanned copy of POC, visa, entry/ exit stamps, etc.)

iv. Proof of Profession and Source of Income/ Funds (e.g. scanned copy of job certificate, tax return, rent agreement, salary slips, etc.)

v. Live Photo of customer

vi. Signature on White paper

vii. FATCA & CRS related declarations

8. Is there any minimum amount required to open an account?

No.

9. What will be the criteria to mark RDA account as “Dormant”?

Any account in which no customer initiated transaction (Debit or Credit) or any activity i.e. successful login through digital channels that include Mobile Application, Internet Banking and RDA portal has taken place during the preceding one year shall be marked as ‘Dormant’.

10. What if customer already has an account with BOP? Can he/she open a Roshan Digital Account as well?

Yes. The customer can open a Roshan Digital Account even if he/she is already maintaining an account with BOP.

11. Can a customer convert an existing normal BOP account to RDA category?

No. The customer will have to open a separate RDA account.

12. Does the customer have to fill application in one session?

No, Information shall be saved automatically during filling account opening form. Customer can fill Account Opening Form digitally in multiple sessions and it will be available till 30 days. However once submitted, customer cannot make any amendments until it is marked discrepant by RDA Unit.

13. How can a customer contact the bank for any query during the account opening or otherwise?

Customer can contact BOP through our 24/7 UAN number +92 21 111 267 200 or through email at rda@bop.com.pk for any query.

14. Can a customer open a joint RDA account?

Yes.

15. Can a customer open more than one RDA accounts in the same category?

No. Only 1 account is allowed in each category/ currency.

16. Will a conventional Roshan Digital account holder be allowed to open an Islamic Roshan Digital Account?

Yes, apart from a conventional banking account, customer can avail the option of an Islamic Banking Account.

17. What is the Turnaround Time (TAT) for account opening?

The account will be opened within 48 hours once the required documents are completed and no discrepancy is outstanding.

18. How would a customer know if there is any discrepancy in account?

An auto email shall be generated to customer’s email address, if account is marked discrepant. Further customer can view the discrepancy after clicking on ’Apply Now’ button on RDA Web page. Customer will enter his/her email address and Verify CAPTCHA code. An OTP will be sent at customer’s email which has to be written in OTP field. Discrepancy in account shall be displayed.

19. Can I also open Islamic Banking Roshan Digital Accounts?

Yes. Following Islamic RDAs can also be opened:

• Taqwa NR Value Current Account

• Taqwa NR Value Savings Account

• Taqwa Foreign Currency Value Current Account

• Taqwa Foreign Currency Value Saving Account

20. What is the Shariah Structure of Islamic RDAs?

Bop Taqwa Current Account is a non-remunerative account based on the concept of “Qard” where the Customer is “lender” and the Bank is “borrower”. The amount deposited by Customer in this account shall remain payable by the Bank to the customer until paid.

Bop Taqwa Saving Account is a profit bearing account based on the principles of Mudarabah, where Customer is “Rab-ul-Maal” and Bank is “Mudarib”. Bank may, at its discretion, use or deploy such funds as it deems fit. Bank shall share the profit on the basis of predetermined profit sharing ratio.

21. When funds can be deposited in account by customer?

Upon satisfactory completion of the requirements, the account Number will be generated and customer will be intimated through auto generated email about account being operational.

22. Can RDA accounts credited with funds from local sources?

No. These accounts cannot be credited with the funds generated from local sources except for the profit/return earned on eligible investments made from these accounts.

23. What type of transactions are allowed in RDA?

Limited transactions are allowed in RDA accounts as described below:

Credit in FCVA:

• Remittances received from abroad through Banking Channels

• Transfer of funds from his own NRVA account within BOP

• Dis-investment proceeds from the permissible investments made from the account

• Reversal of any incorrect entry.

Debit from FCVA:

- Investments in Permissible securities

• Registered Debt Securities of Govt of Pakistan (in case of Islamic RDA investment is permissible in Shariah Compliance securities only)

• Residential and Commercial Real estate

• Term Deposit products of BOP

- Transfer of funds to own NRVA within BOP

- Transfer to other FCY, PKR and Non-Resident Rupee account with any bank in Pakistan

- Remittances and payments outside Pakistan

- Cash Withdrawal in Foreign Currency and equivalent local currency

- Any payment in PKR to any person resident in Pakistan.

- Reversal of any incorrect entry

Credit in NRVA:

• Remittances received from abroad through Banking Channels

• Transfer of funds from own FCVA and other NRVA within BOP

• Proceeds from disinvestment

• Reversal of any incorrect entry

Debit from NRVA

- Investments in Permissible Securities

• Registered Debt Securities of Govt. of Pakistan

• Shares quoted on the stock exchange in Pakistan

• Residential and Commercial Real estate

• Term Deposit products of BOP

- Transfer of funds to account holders own FCVA and other NRVA within BOP

- Transfer of funds to other FCY, PKR and Non-Resident Rupee Account

- Remittances and payments outside Pakistan

- Any local withdrawal or payment in PKR to any person resident in Pakistan

- Any payment in PKR to any person resident in Pakistan.

- Reversal of any incorrect entry

24. Can a customer repatriate funds from these accounts?

Yes. Customers can take back their funds into their country from both PKR Account and FCY Account.

25. Can a customer get Cheque Book and Debit Card on NRVA and FCVA account?

Debit card will be issued only to NRVA holder. Both NRVA and FCVA holders can request for issuance of cheque book and collect the same upon his/her visit to BOP Branch in Pakistan.

26. What are the charges for Debit Card?

Charges are displayed under SOC summary available at the RDA portal.

27. How debit card will be applied & activated”?

Customer can request for debit card through RDA portal by narrating requirement in ‘Any other Request’ form as well as via e-mail. However, activation of debit card will be through call at Contact Centre.

28. Would Debit Card be delivered internationally to customers?

Yes, through courier.

29. Are there any charges by BOP for remittances into my Roshan Digital Account?

No. There are no charges by BOP for any incoming remittances into the Roshan Digital Account. Charges may, however, be applied by the overseas Bank for the remittances.

30. Are there any taxes on Remittance?

No, there are no taxes on Remittances. However, WHT will be levied, where applicable, as per the regulatory requirement.

31. Is compulsory deduction of Zakat, under Zakat & Ushr Ordinance 1980, applicable on RDA?

No, in terms of Section 3(1)(a)(b) of the Zakat and Ushr Ordinance, 1980, read with Rule 24-A of the Zakat Collection & Refund Rules, 1981, compulsory deduction of Zakat is not applicable on RDA (both FCVA and NRVA).

32. What will happen in case of death of RDA holder?

In case of death of the account holder, the balance available in the account and the outstanding investment made from the account including accrued profit/return, if any, will be paid to the legal heirs of the deceased in accordance with applicable law of inheritance.

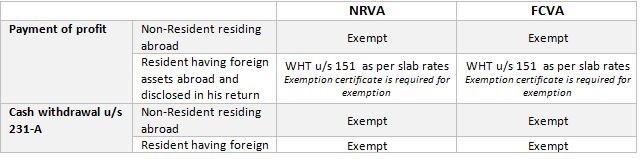

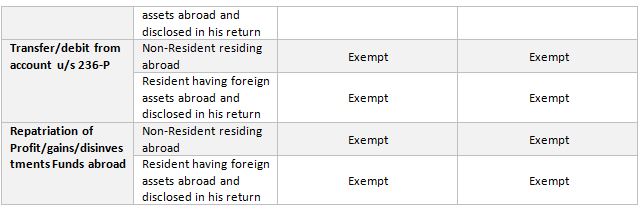

33. What are the tax obligations for Roshan Digital Account holders?

34. Tips for remitting funds.

34. Tips for remitting funds.