EFU Takaful Child Savings Plan

When it comes to your life, nothing else matters but your children. Everyone thrives towards providing their children with the best possible future. With a well-planned investment and protection plan, you can give your children a brighter and safer future despite the challenges of life and help them establish stability into their lives by giving them quality higher education and by planning their wedding without worrying about their expenses. To secure the future of your children EFU Life – Window Takaful Operations introduces EFU Takaful Child Savings Plan, which is an investment-linked takaful product and a Shariah compliant regular contribution plan that comes with a unique continuation benefit. This plan helps you establish a safe and secure future for your child’s most important life events, i.e., their higher education and marriage. The returns on investment and cash values are generated regardless of any life challenges. Moreover, the continuation benefit ensures that the payment of contribution continues regardless of any unforeseen circumstances, in your absence. This Plan has been reviewed and approved by the Shariah Advisor of EFU Life - Window Takaful Operations, Mufti Muhammad Ibrahim Essa who is a prominent scholar from Jamiah Darul Uloom Karachi and has a vast experience of Islamic finance and takaful.

Important Details:

| Eligible Age |

18 to 65 years |

| Minimum Plan Term |

10 years |

| Maximum Plan Term |

25 years |

| Maximum Age at Maturity |

75 years |

| Minimum Contribution |

PKR 20,000/- per annum |

| Mode |

Annually |

| Fund Acceleration Contribution |

Minimum PKR 20,000/- |

*Note: Please contact takaful representatives designated at BOP branches who will help you develop the most suitable plan for your needs

Disclosure of Product

This is a Family takaful product which has two distinct elements i.e., Protection and Investment. The Investment Component is linked to the performance of underlying assets under unit linked fund(s).

Free Look Period:

if you cancel your membership within free look period of 14 days from the date of the documents receipt, you are entitled for a full refund of Contribution as a benefit less any expenses incurred by EFU Life - WTO in connection with our medical or clinical examinations.

What is Takaful?

Takaful is a Shariah compliant way of safeguarding yourself and your family against future financial losses. A Takaful product assists participants to share their risk on the basis of cooperation, brotherhood, mutuality and solidarity for the common good.

How does the Takaful Membership operate?

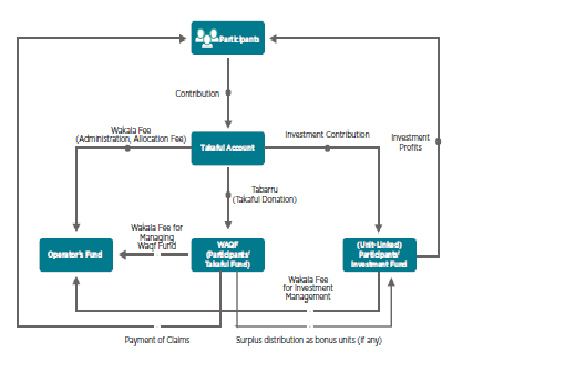

EFU Life’s Takaful model is founded on the Wakalah-Waqf principle. Individuals in the community come together for a common purpose and contribute into a Waqf Fund operated by a Takaful Operator to protect themselves against future financial losses. The following pictorial representation summarizes how your Takaful membership will operate with EFU Life - WTO:

What is Surplus Sharing?

Takaful offers a unique feature of Surplus Sharing to the Participants in addition to risk mitigation benefits. By contributing Tabarru (donation) into the Participant’s Takaful Fund (PTF), the participant may be entitled to a share of possible surplus funds. At the end of each year, EFU Life –Window Takaful Operations will determine the surplus in the PTF based on the method approved by the Shariah Advisor and Appointed Actuary.

What are the benefits of Surplus Sharing?

A part of the surplus may be distributed back to the participant in the form of Bonus Units through additional unit allocation in the Participant’s Investment Account (PIA). These Bonus Units will enhance the Cash Value of your Takaful plan.

Waqf Donation:

Waqf Donation, which depends on the Takaful cover and age of the Participant, will be transferred from Basic Plan Contribution into Participants Takaful Fund (PTF).

Opportunity for Growth

You can select from the following unit linked funds mentioned below:

All available funds are categorized with their risk profiling as per the investment criteria.

EFU Takaful Growth Fund

Fund Categorization: Balanced Risk Profile: Medium

A unit-linked Participants’ Investment Fund (PIF) comprising Shariah-Compliant

investments. The objective of the fund is to maximize capital growth by

investing in a portfolio spread across a wide range of investments such as

Islamic mutual funds, approved equities, term deposits in.

EFU Takaful conservative Fund

Fund Categorization: income fund Risk Profile: Low

EFU Takaful Conservative Fund has a conservative investment allocation strategy and low risk. This is a unit-linked Participants’ Investment Fund (PIF) comprising Shariah-compliant government securities, non-equity Shariah compliant mutual funds, Shariah-compliant short-term deposits, and cash in Islamic banks or Islamic windows of conventional banks. The fund aims to provide stable investment returns with minimal risk and is suitable in times of the volatile stock market.

EFU Takaful Aggressive Fund

Fund Categorization: Aggressive Risk Profile: High

A unit-linked Participants’ Investment Fund (PIF) comprising Shariah-Compliant

investments, aimed at maximizing capital growth by using investments with an

aggressive market outlook.

Multiple Fund Option

Under this option you have a facility to select a mix of two unit linked funds of the plan. Total Contribution under your membership will be allowed to be distributed in funds in multiples of 10%. It means that the funds split can be of 90/10, 80/20, 70/30, 60/40 or 50/50.

*EFU Takaful Conservative Fund to be selected by default

Benefits:

Continuation Benefit

On death of participant prior to the maturity of plan, the plan ensures that your child’s future remains secure by its Continuation Benefit. This is built into the plan and ensures that all future Contributions are paid by PTF following the death of the participant until the Plan’s maturity date. This means that the funds you had originally planned for your child will still be available.

Maturity Benefit

At the end of the Membership Term, the maturity benefit payable will be

The Cash Value of Participant’s Investment Account from basic plan contributions.

Plus

The Cash Value from Fund Acceleration Contribution (FAC) in the Participant’s Investment Account (PIA) if any.

PRIMUS Benefits

EFU Life presents PRIMUS – an exclusive class of service excellence tailored to deal with life’s continually evolving scenarios. Hemayah PRIMUS is meant for our high net worth clients and gives them an experience beyond the ordinary and provides you with personalized services. Participants of Child Savings Plan can avail the impressive PRIMUS benefits. For details, you can access primus.efuhemayahtakaful.com.

Built-In Takaful Income Benefit

This benefit ensures that a quarterly income is paid to the family of the participant, in case of an unfortunate event of his death.

Built-In Pilgrimage Benefit

During the Plan term, if the Participant travels for religious pilgrimage, EFU Life - WTO offers coverage on death due to an accident while performing pilgrimage (Hajj, Umrah or Ziarat- religious journey etc.) The coverage under this accidental benefit will be 100%of the Main Plan Sum Covered, subject to a maximum limit of PKR 100,000. This feature will be applicable for an additional period of 13 months from the date of

maturity or from the date of full surrender.

Built-in Takaful Waiver of Contribution

In case the Participant is unable to follow his/her occupation due to the sickness or accident, the contribution of the plan would be made by WAQF Fund/ PTF managed by EFU Life Contribution for this built-in rider shall be charged on the top of the basic plan contribution.

Optional Benefits

The Plan also offers various supplementary benefits which may be attached to it in order to enhance the Takaful protection. These supplementary benefits are:

Takaful Accidental Death Benefit*

This benefit provides an additional lump sum benefit on accidental death of the participant.

Takaful Accidental Death and Disability Benefit*

In case of accidental death or disability of the Participant, this rider provides an additional lump sum benefit.

Takaful Accidental Death and Disability Benefit Plus*

In case of accidental death or disability (including Permanent and total disability) of the participant, this rider provides an additional lump sum benefit.

*Any one of the accidental death benefits can be selected at a time.

Additional Term Takaful

This benefit increases the level of Takaful cover by providing an additional amount in the range of 50% to 200% of the Main Plan Sum Covered, in case of death of the Participant.

Takaful Family Income Benefit *

This benefit ensures that a monthly income is paid to the family in case of the unfortunate death of the participant during the plan term.

Takaful Lifecare Enhanced Benefit

This rider provides a flexible benefit ranging from Rs. 50,000 to sum equivalent to main plan sum covered subject to a maximum of Rs.500,000, upon the diagnosis or the occurrence of any 20 covered critical illnesses.

Takaful Return of Contributions Benefit

The Return of contribution benefit is a unique rider offered to prospective EFU Hemayah Takaful participants. This rider enhances your coverage by giving you an extra benefit. In an unforeseen event of death of the life covered, the beneficiary will not only receive the death benefit, but will also be able to receive the total amount of paid contribution as a benefit from the Waqf fund (PTF) excluding the contribution paid for the ROCB rider.

Unit Allocation

The proportion of basic plan allocated to the policy is shown below:

| Year 1* |

57.5% | 42.5% |

| Year 2 |

80% | 20% |

| Year 3 |

90% | 10% |

| Year 4 to 5 |

100% | 0% |

| Year 6 to 10 |

103% | 0% |

| Year 11 to 15 |

105% | 0% |

| Year 16 to 20 |

107% | 0% |

| 21 & Onwards |

110% | 0% |

*First year allocation is valid from 1st July 2023 to 30th June 2024.

100% of FAC payment is allocated to purchase units

**Allocation fee will be deducted from the Paid Contribution every year as per the above table and the remainder will be allocated to the PIA.

Fund Acceleration Contribution (FAC):

If you have surplus cash available at any point of time during the plan term, it can be invested in the plan to enhance your cash value. These additional payments in the plan are called Fund Acceleration Contribution payments. You can make these payments at any time while the membership is in force. The minimum FAC payment is Rs. 20,000.

Complete and Partial Surrender:

The plan always provides complete access to accumulated fund value. Total units accumulated (either partially or fully) can be withdrawn after the first year’s regular contribution payment. A facility for partial withdrawals is also available subject to Rs.20,000 remaining in the fund. If the customer opts for complete surrender, all units will be encashed and the plan will be terminated.

Indexation

This option gives you the security and peace of mind of knowing that the benefits provided by your plan will be automatically updated in line with inflation every year regardless of your health. Once you select this option, the contribution will increase every year by 5% of the prior year’s contribution up to 55 years of age.

Charges

Wakalat ul Istismar:

- Administration Charge: Rs. 1500 per annum.

- Investment Management Charge: 1.5% of the fund value per annum.

- Bid/Offer Spread: 5% of the net contribution.

- Allocation charges: As per the above ‘’Unit Allocation’’ table.

- Takaful Donation (Waqf Donation): An age-based Takaful Donation applies for the Takaful cover each year and is dependent on the sum at risk. No Takaful Donation charges applies in years where the cash value exceeds sum covered.

Wakahla charges:

40% of the Takaful donation.

Claim

In case of an unfortunate event, you may file your claim intimation through your BOP Branch walk in, visiting the EFU Head O_ce or by visiting any of the EFU branches in the country. For a swift speedy process, you may also call us at our call center (021-111-338-436) or simply visit our website, fill in the intimation form and email it to us at cod@efuhemayahtakaful.com. Thereafter, you will be contacted for next steps.

Disclaimer

- This product is underwritten by EFU Life - Window Takaful Operations. It is not guaranteed or covered by Bank of Punjab or its affiliates and is not a product of Bank of Punjab. Hence EFU Life - Window Takaful Operations is responsible for all underwriting risk.

- Bank of Punjab is just a promoter/ distributor and corporate takaful agent of this product to its valued customers.

- Growth in the value of your contribution will depends on the performance of the selected Fund in which the contributions are invested.

- All investments made in the selected Fund are subject to market risks. The investment risk of the selected fund will be borne by the participant.

- Arrangements of all Takaful Claims, charges and payments relating to the Takaful Policies shall be the sole and exclusive responsibility of EFU Life - Window Takaful Operations.

- The past performance of the fund is not necessarily a guide to future performance. Any forecast made is not necessarily indicative of future or likely performance of the funds and neither EFU Life – Window Takaful Operations nor Bank of Punjab will incur any liability for the same.

- A personalized illustration of benefits will be provided to you by our consultant. Please refer to the notes in the illustration for detailed understanding of the various Terms and Conditions; you are required to fully understand the illustration and other terms and conditions of the plan.

- Service Charges and taxes will be applicable as per the Bank’s schedule of charge and taxation laws as stipulated by relevant authorities.