Vitality Takaful Plan-IGI Life WTO

Live healthy, Earn rewards & Save money

Vitality Plan – IGI Life takes a unique approach for integrating better health and better care, which truly sets us apart from any other takaful plan in the market.

Vitality Plan – IGI Life offers rewards, in the form of Food panda & Mobile Top-up vouchers. It also puts an equal focus on better health, by helping you to stay healthy. This combination of bringing the two together into one truly integrated offering is the real power of Vitality. As you engage with the Vitality Programme and benefit from better health, it enables us to share some of the takaful savings that emerge in the form of better product benefits and incentives – fueling a virtuous cycle.

Plan Objective

The Plan that provides, Takaful benefit can save your money and offers tools & resources to help you live a healthier life. Because when you live healthy, you can earn rewards and save money. So, start discovering your path to a healthier, happier you .

Important Details

| Eligibility Age |

18-65 years nearest birthday |

| Maximum age at Maturity |

85 years Birthday |

| Membership Term |

10 years up to the age 85 years at maturity |

| Annual Minimum Contribution |

PKR 100,000 |

| Mode of Contribution |

Yearly |

| Contribution Paying Term |

10 years and the maximum can go up to the membership term chosen. |

| Sum Assured |

Annualized Basic Contribution x Cover Multiple |

| Unique Feature |

Vitality Integrated Life Insurance |

Free Look Period

If you cancel your membership within a free look period of 14 days from the date of receipt of the membership documents, you are entitled to a full refund of contribution less any expenses incurred by IGI Life WTO in connection with your medical or clinical examinations.

What is Takaful ?

Takaful is an age-old Islamic concept of mutual help & support blended with modern concepts of Actuarial Science, Underwriting and Investment under the supervision of a Shari'ah Advisor. It is a Shari’ah-compliant way of supporting each other in case of any unforeseen adverse event.

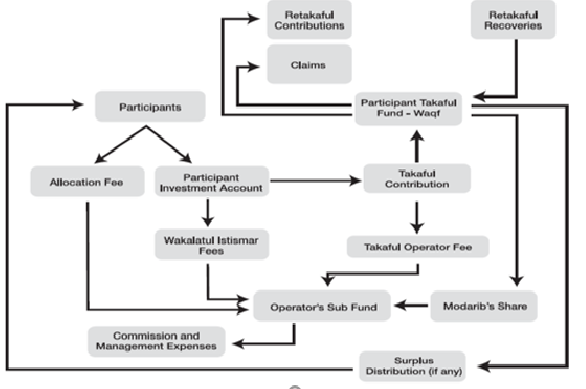

How does Takaful model work ?

How Does the Takaful Membership Operate ?

IGI Life - WTO's takaful model is based on the Wakalah-Waqf principal. Individuals in the community come together for a common purpose and contribute into a Waqf Fund operated by a Takaful Operator to protect themselves against future financial losses.

Surplus Sharing

Participants of the Takaful fund, as per the terms and conditions of the Waqf, may be entitled to a share of possible surplus funds Takaful offers a unique feature of Surplus Sharing to the Participants in addition to risk mitigation benefits. As approved by the Shari'ah Advisor and Appointed Actuary at the end of each year, IGI Life - Window Takaful Operations will determine surplus (if any) available in the PTF for distribution.

Protection Benefit

In the unfortunate event of death, the higher of Account Value or Sum Covered (less any partial withdrawals) PLUS Account Value of TOP UP (if any), is payable.

The range of Cover Multiples offered under this plan is 5-70.

For example, if your annual basic contribution is PKR 250,000 and you have selected a cover multiple of 5, your total sum assured would be PKR 250,000*5= PKR 1,250,000.

The Sum Covered amount will be a multiple of the Basic Contribution depending on the age of the customer as follows:

| Age |

Cover Multiple |

| Minimum |

Maximum |

| Up to 55 |

5 |

50 |

| 56 to 60 |

5 |

15 |

| 61 & onwards |

5 |

5 |

Maturity Benefit

On completion of the membership term, the available Participant’s Investment Account (PIA) value along with the account value of Top-Up Account (if any) and surplus (if any) will be payable to the participant in Lump Sum.

Vitality Benefits:

Weekly Active Rewards:

In the 1st week of activating the IGI Life Vitality app, the member gets a target to complete 300 points in a week.On completion (achievement) of the weekly Active Reward goal, the customer will have the option to select:

an EasyTickets voucher as their reward. The voucher will be for a 50% discount off on a cinema ticket booking with EasyTickets.

OR

a Rs. 500 Mobile Top Up voucher with Easytickets.

OR

a FoodPanda voucher as their reward. The voucher will be for a PKR 500 discount off a FoodPanda order at selected restaurants.

Monthly Reward – Fitness Device Cash Back Benefit :

Along with the weekly rewards, Vitality Members can earn up to 100% cash back towards the purchase price of a selected Fitness device over a 24-months period*, up to a maximum cashback cap on the purchase price. The member can earn their monthly cashback by performing physical activities over the course of the month, and subsequently earning the respective physical activity Vitality Points for those activities. By reaching a required physical activity points’ threshold throughout the particular month, the member will receive an applicable cashback percentage level for reaching that particular points’ threshold.

This Device Cashback gets credited to the participant’s account value every month according to the following table.

| Points earned in a month |

Device Cashback per mont |

| < 1500 |

0% |

| 1500 – 1,999 |

25% |

| 2000 – 2,999 |

50% |

| 3,000 or more |

100% |

*Terms & Conditions apply

Annual Vitality Integrated Benefit:

At every fifth Membership anniversary, an additional amount (% of Contribution) will be paid into the account value as Vitality Integrated Benefit, subject to achievement of Silver, Gold, or Platinum status. The percentage of the integrated benefit is dependent on the Vitality Status and the Sum covered multiple at the end of each year in the preceding 5-year period. The table below shows the percentages of the Vitality Integrated benefit:

Integrated Benefit

| Face Amount Multiple |

Status |

|

| Bronze |

Silver |

Gold |

Platinum |

| 5 to 10 |

0.0% |

0.0% |

0.0% |

0.0% |

| 11 to 20 |

0.0% |

2.0% |

4.0% |

9.0% |

| 21 and higher |

0.0% |

4.0% |

8.0% |

18.0% |

The Bronze, Silver, Gold and Platinum Statuses refer to the status achieved by a member as a result of achievement of various goals and assessments/questionnaires, as set out under the terms and conditions.

How Vitality Works

Vitality rewards its members through a point system based upon physical activity and certain health-related questionnaires. The program runs through the Vitality app on the participant’s smartphone and points can be measured through the Health app or an optional wearable device.

Daily Points are awarded based on the number of steps taken for the day or increased heart rate to a level for a minimum of 30 minutes, whichever is higher.

Physical activity is measured through the Samsung Health app on android phones and the Health App on Apple iPhones. Both these apps sync with the IGI Life Vitality app in order to transfer the data to Vitality.

Points are awarded as per the below table:

Steps :

| Activity Level |

Steps Per Day |

Points Awarded |

Age 60+ boost |

| Minimum |

5,000 – 7,499 |

0 |

50 |

| Light |

7,500 – 9,999 |

50 |

50 |

| Moderate |

10,000 – 14,999 |

100 |

50 |

| Vigorous |

15,000+ |

200 |

50 |

Heart Rate :

| Activity Level |

Duration & Heart Rate |

Points Awarded |

Age 60+ boost |

| Moderate(60+) |

20 minutes of physical activity at 60% of age-related max heart rate |

100 |

50 |

| Moderate |

30 minutes of physical activity at 60% of age-related max heart rate |

100 |

50 |

| Vigorous |

30 minutes of physical activity at 70% of age-related max heart rate

60 minutes of physical activity at 60% of age-related max heart rate

|

200 200 |

50 50 |

| Extended Duration Vigorous |

360+ minutes of at 70% of age-related max heart rate

90+ minutes of at 60% of age-related max heart rate

|

300 300 |

50 50 |

Vitality Fee :

A fee of PKR 320 will be deducted at the beginning of each month for each member from the account value. Vitality Fee may vary from time to time, at the discretion of the Company. If the customer has more than one membership of the Vitality Integrated product, then Vitality Fee will be deducted from one membership only; no deduction of Vitality Fee will be made from the other Vitality integrated policies. The details are in the Terms & Conditions.

Optional Supplementary Benefits* :

The plan allows you to choose from a range of supplementary benefits. The list of these benefits and their respective description is mentioned below.

Additional Protection Benefit:

APB enhances the benefit payable on participant's death, whether due to accidental or non-accidental causes. The APB face amount is payable in a single lump sum in addition to any other death benefit payable under the basic membership.

Accidental Death Benefit:

ADB pays a lump sum amount in case of accidental death of the participant.

Waiver of Contribution – Disability:

WoC waives the future contributions in case of permanent total disability due to sickness and accident of the covered person up to the end of the term.

Income Benefit - Death/Disability:

A monthly income benefit will be paid following the permanent total disability/death of the participant up to the end of the elected term.

Sehat Afza:

Provides financial protection in case of illness or accident that leads to hospitalization to cover in-patient expenses.

Hifz O Amaan:

If the covered person is diagnosed with any one of the covered conditions, this benefit will pay up to the limits stated in the membership term.

*Additional contribution will be charged for each optional rider.

Top Up Contributions (TOP UP)

The Plan is a regular Contribution plan but you may top-up the regular Contributions by depositing surplus funds as lump-sum Contribution in the Plan. These lump-sum Contributions, called "Account Value Acceleration Contribution" (TOP UP) payments can be made at any time. The TOP UP payments will increase the Account Value of the Plan, but will not affect the basic sum at risk.

Continuous Coverage

If you are not able to pay your Contribution after the first Membership year, your sum covered amount will still be payable as long as your account value is sufficient to pay for charges made against your Membership.

Contribution Indexation:

Indexation is an optional feature offered in this plan. Under this feature your contributions and sum covered will increase by a fixed amount every year leading to a better cash value accumulation and consequently a higher maturity benefit. Even once opted, you still have a right to decline the option and continue paying level contribution subject to certain terms and conditions.

Withdrawal of Investment

This plan provides you the option to withdrawal the cash value of your Membership, by encashing the number of units partially or completely after the first two Membership years.

Partial Surrender

The minimum partial withdrawal amount is PKR 10,000, and the maximum can go up to 50% of Account Value as long as an amount of PKR 250,000 remains in the Account Value. A partial withdrawal will, however, reduce the Account Value and Sum Assured Amount by the amount of partial withdrawal.

Complete Surrender

In case of complete surrender during the first two membership years, a surrender charge (as tabulated below) will be deducted. In such an event the units will be redeemed at the bid price and the membership will be terminated.

| Membership Year |

% Account Value |

| 1 to 2 |

100% |

| 3 onwards |

Nil |

Contribution Allocation Percentage

Vitality Takaful Plan – IGI Life WTO offers one of the best Contribution allocations thereby optimizing the returns on your investment. The proportion of Basic Contributions and TOP UP allocated to Participant Account Value is as follows:

| Membership Year |

% Allocation of Contribution to

Participant Account Value |

| 1 |

57.5% |

| 2 |

75% |

| 3 |

95% |

| 4 to 5 |

100% |

| 6 to 15 |

104% |

| 16 & onwards |

105% |

| Top - Up |

100% |

*First-year allocation is valid till 30th June 2024.

Extra Unit Allocation

The longer you continue the Plan, the higher rewards you will gain in the form of extra unit allocation. The extra unit allocation, starting from membership year 06, is as follows:

| Membership Year |

Extra Unit Allocation as % of

Basic Contribution |

| 6 to 15 |

4% |

| 16 & onwards |

5% |

Unit Pricing Methodology:

The underlying funds are valued at market value on a daily basis. The Underwriting Department clears the applications/builds the membership. On each Unit Valuation Day (UVD) the total net contribution figure (reflecting contribution receipts, claims, withdrawals, and switching received is provided to the Accounts Department, which invests the Contribution in the mutual funds )to buy units for the umbrella funds on the same day.

At the end of UVD, the NAV of the umbrella fund is re-calculated given the prices of mutual funds as of that date. The revised NAV is divided by the number of units in the umbrella fund to determine the revised bid price and another price (105% of the bid). The NAV of the additional investment made in the mutual funds is divided by the existing unit price of the umbrella fund (as calculated above) to determine the additional units added to the umbrella fund. The umbrella fund prices thereby calculated (based on the prices of mutual funds as at the end of UVD are input into the system the next morning and all transactions are accordingly carried out i.e. allocation of units with respect to Participation in Takaful Membership, surrender, switching etc. The umbrella fund prices which are put in the system are updated on our website every day for the knowledge of the participants and are also communicated to the field office to facilitate their Distribution of Takaful Membership.

Opportunities for Growth

You have the option to choose from the following Investment Strategies to match your risk profile and financial objectives :

| IGI Takaful Conservative Strategy |

| Funds Classification: Income Fund - Takaful (Shariah Compliant) |

| Category of Unit Linked Funds (Risk Profile):Low |

| The underlying assets include Shariah compliant government and/or other secured investments.

There will be little exposure to stock market under this strategy. |

| Shariah Compliant Government securities and/ or Other Shariah Compliant fixed income investments:

up to 100% |

| IGI Takaful Balanced Strategy |

| Funds Classification: Balanced Fund - Takaful (Shariah Compliant) |

| Category of Unit Linked Funds (Risk Profile): Medium |

This strategy seeks steady growth in capital through a combination of investments in Shariah compliant stocks,

government securities and/ or other secured investments. The mix of underlying assets would be:

Shariah Compliant Stock Market Funds: 0 to 40%

Shariah Compliant Government securities and/ or Other Shariah Compliant fixed income investments: 60 to 100%

|

| IGI Takaful Aggressive Strategy |

| Funds Classification: Aggressive Fund - Takaful (Shariah Compliant) |

| Category of Unit Linked Funds (Risk Profile): High |

This strategy seeks to provide long term capital growth mainly through investments in Shariah Compliant equities.

The mix of underlying assets here would be:

Shariah Compliant Stock Market Funds: 60 to 70%

Shariah Compliant Government securities and/ or other Shariah Compliant fixed income investments: 30 to 40%

|

Under each strategy, you have an investment account as listed in the application. The percentage of Contribution you wish to allocate to buy units in an investment account should be indicated in the application.

Your Contributions, by default, will be allocated to Secure Strategy of IGI Life Window Takaful Plan. However, you have the option to invest in any fund by signing the declaration form.

Unit Linked Fund Selection :

At the time of issuance, as a default units will be allocated to a low-risk fund. After the membership has been issued the participant will have the option to reallocate the units in the fund of his choice, based on his risk appetite, at no additional fee. The new fund mix can comprise of multiple funds and will be at the participant's discretion as long as the total of the mix is 100%.

What is the Wakalah Fee (Allocation Fee) ?

The Wakalah Fee as a percentage of the contribution on the IGI Life WTO Vitality Takaful plan is as follows:

| Membership Year |

% Allocation of Contribution |

| 1 |

42.5% |

| 2 |

25% |

| 3 |

5% |

Charges & Fees

The bank does not have any fees or charges related to this product. However, IGI Life WTO has the following charges and fees:

| Wakalatul Istismar fees |

0.125% of Participant’s Investment Account (PIA) value per month charged at the beginning of month |

| Mudarib Share |

40% share in the investment income of the Individual PTF (if any) |

| Takaful Operator’s Management fee in Takaful contributions |

35% of each month’s takaful contributions (Tabarru or COI) |

| Wakalah Fee on Early Withdrawal (% of PIA) |

50% - 1-2nd year Nil – 3rd year onwards

|

| Admin Charge |

PKR 175 per month |

| Bid Offer Spread |

5% |

| Investment Strategy Switching Fee |

PKR 500 per switch |

| Processing Fee |

PKR 500 on each partial withdrawal and complete surrender |

| Vitality Fee |

PKR 320 per month |

*All charges & fees are reviewable by the Takaful Operator.

Claim

In case of an unfortunate event, you may file your claim intimation through your BOP branch walk-in, visiting the IGI Life Head Office or by visiting any of the IGI Life branches in the country. For a swift speedy process, you may also call us at our UAN (021 111-111-711) or simply visit our website, fill in the intimation form and email it to us at services.life@IGI.COM.PK. Thereafter, you will be contacted for the next steps. Always remember to mention the current address and contact number of the claimant while submitting an intimation.

Disclaimer :

- This product is underwritten by IGI Life - Window Takaful Operations. It is not guaranteed or covered by Bank of Punjab or its affiliates and is not a product of BOP. Hence IGI Life - Window Takaful Operations is responsible for all underwriting risk.

- Bank of Punjab is just a promoter/ distributor and corporate takaful agent of this product to its valued participants.

- Arrangements of all Takaful Claims, charges and payments relating to the Takaful Memberships shall be the sole and exclusive responsibility of IGI Life - Window Takaful Operations.

- The past performance of the fund is not necessarily a guide to future performance. Any forecast made is not necessarily indicative of future or likely performance of the funds and neither IGI Life - Window Takaful Operations nor BOP will incur any liability for the same.

- A personalized illustration of benefits will be provided to you by our consultant. Please refer to the notes in the illustration for detailed understanding of the various Terms and Conditions; you are required to fully understand the illustration and other terms and conditions of the plan.

- Service Charges and taxes will be applicable as per the Bank’s schedule of charge and taxation laws as stipulated by relevant authorities.

- A description of how the contract works is given in the Participant Membership Documents. This product’s brochure only gives a general outline of the product’s features and benefits.

- If you have any grievance regarding your Takaful Membership, you may contact IGI Life Window Takaful Operations on (021) 111-111-711.

Please Note: This is a brochure not a contract. The detailed Terms & Conditions are stated in the Membership document.

Contact details

In case of complaint, claim or further details, you may contact:

IGI Life Insurance Limited-Window Takaful Operations

Suite No. 701-713, 7th Floor, The Forum, G-20, Block-9, Khayaban-e-Jami. Clifton, Karachi – 75600.

Tel: (+9221) 111-111-711

Fax: (+9221) 3529-0042

Website: www.igilife.com.pk

Bank of Punjab

UAN: (+92 21) 111-267-200,/b>

www.bop.com.pk/